When To Consider A Personal Loan For Financial Independence

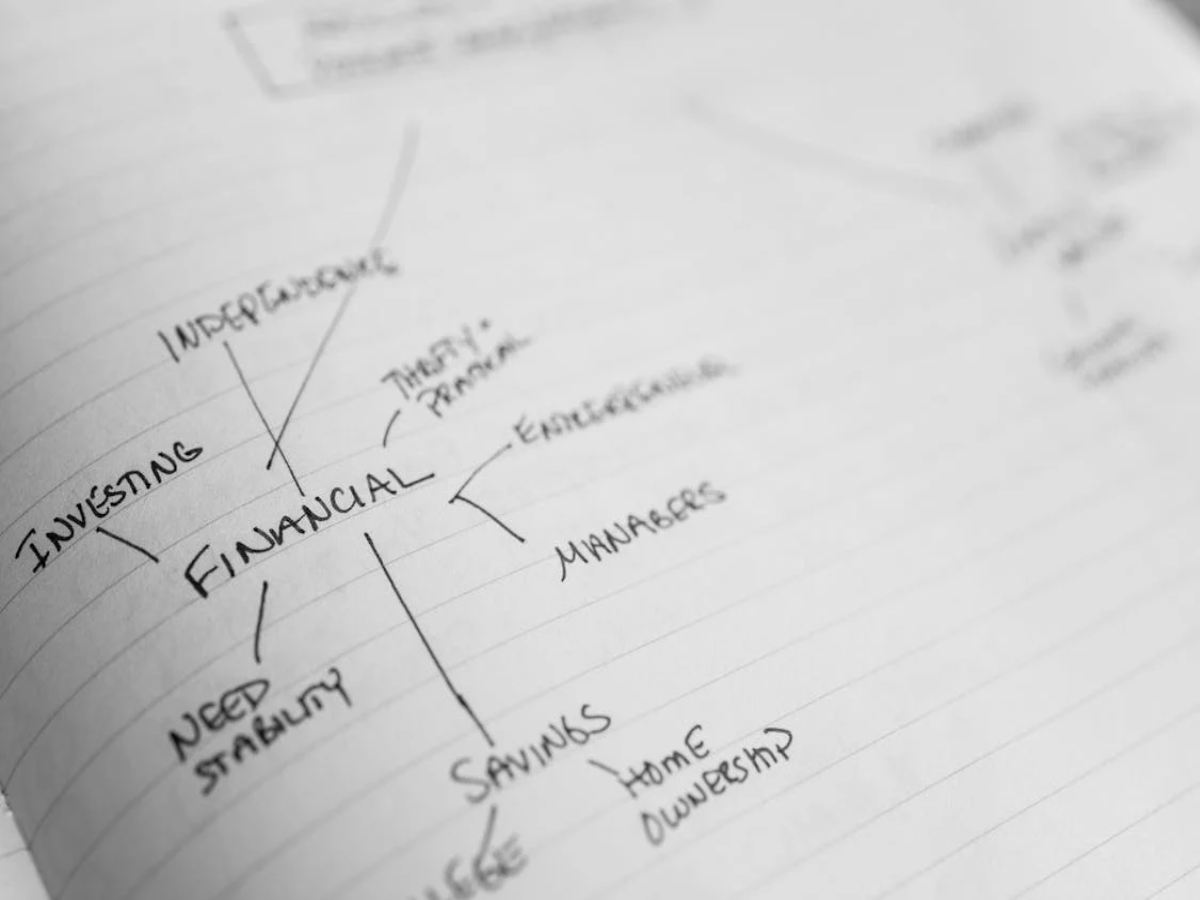

To be financially self-sufficient means you do not require outside sources for assistance, which is an important achievement. However, to accomplish such aspirations, one needs to follow long processes which involve financial management, this is where a Personal Loan comes in handy. Personal Loans allow one to make immediate payments, pay off existing debts or make any investments that can be beneficial in the future.

Table of Contents

Situations Where a Personal Loan Can Be Beneficial

1. Combining multiple debts

Debt consolidation can significantly reduce financial stress. If you’re managing multiple credit card bills or high-interest loans, a personal loan can simplify your repayments by combining various debts into one, ensuring you only need to track a single payment schedule. It can also potentially lower your overall interest rate, especially if the debts being consolidated are credit card balances or payday loans, which often have very high interest rates. This also helps you avoid late fees by making repayment easier to manage, ultimately improving your credit score. This approach not only saves time and effort but also enhances your financial planning.

2. Funding Higher or Professional Education

Education is one of the most valuable investments you can make, but it often comes with significant upfront costs. With a personal loan you can cover tuition fees for degree programs, certifications, or skill-based courses that can improve your career prospects. This can also help with related costs like books, supplies, exam fees, or even living expenses if your education requires relocation. Unlike student loans, personal loans can be used flexibly, which is ideal for short-term courses or certifications that may not qualify for traditional education loans.

3. Coping with Emergencies or Rising Costs

Life is unpredictable, and unexpected expenses such as medical emergencies, urgent repairs, or unplanned travel can arise at any time. When such costs are not accounted for in your budget, a personal loan provides a quick and reliable solution. With fast approvals, flexible repayment terms, and no need to liquidate investments, personal loans ensure you have timely access to funds to manage emergencies effectively.

4. Organizing resources for a business

Starting a side business, freelance activity, or professional venture is an excellent way to augment income and enhance financial security. However, most businesses involve setup costs, including purchasing equipment, marketing, and covering operational expenses. A personal loan provides the capital needed to start or expand your business without disrupting your savings or monthly cash flow. With a solid strategy, profits from the business can eventually cover loan repayments and generate additional income.

5. Renovations aimed toward added value

Renovating your home not only improves your quality of life but also enhances your property’s value. Upgrades such as kitchen remodelling, energy-efficient installations, or expanding living space can deliver long-term returns. A personal loan is a practical funding option for such improvements, allowing you to make significant upgrades without depleting your savings.

Conclusion

While a personal loan is a versatile solution for various financial needs, it is essential to borrow for the right reasons and within your repayment capacity. Carefully review your financial situation, calculate your monthly repayment obligations, and ensure the loan contributes positively to your financial stability. When used wisely, a personal loan can serve as a stepping stone towards achieving financial self-sufficiency and securing a better future.